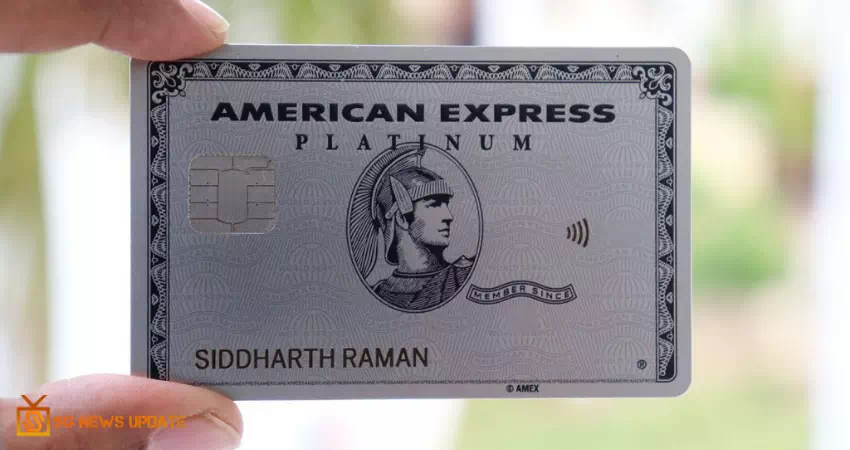

The Reserve Bank has limited American Express Banking Corp and Diners Club International Ltd from on-boarding new home-based clients onto their card networks from May 1 for disregarding information stockpiling standards.

The order won't affect the current clients of these two bodies, the national bank said in an explanation on Friday. American Express Banking Corp and Diners Club International Ltd are Payment System Operators approved to function card networks in the country under the Payment and Settlement Systems Act, 2007 (PSS Act).

The RBI has forced the limitations on American Express Banking Corp and Diners Club International by an order dated April 23, 2021. "These elements have been discovered rebellious with the bearings on Storage of Payment System Data," the RBI said. The administrative activity, it added, has been taken in exercise of powers vested in RBI under the PSS Act.

In April 2018, all payment framework suppliers were coordinated to guarantee that inside a time of a half year the whole information (full start to finish exchange subtleties/data gathered/conveyed/prepared as a feature of the message/payment guidance) identifying with payment frameworks functioned by them is put away in a system just in India.

They were additionally needed to report consistence to RBI and present a board validated System Audit Report (SAR) led by a CERT-In empanelled examiner inside the courses of events determined.

Coming Soon...!

Comments (0)